Governance

Governance

Governance

Corporate governance at DELA stands for prudent management, good oversight and transparent accountability. We focus on the long-term interests of our members: costs and risks are carefully monitored and opportunities identified. The strength of DELA lies in its entrepreneurship and flexibility to address risks and seize opportunities. We do this with a clear ambition that is based on our core values, ensuring the quality of ethical business operations and the principles of a learning organisation.

Corporate governance

Governance charter

The governance structure is detailed in a governance charter. This ensures that we comply with decrees and regulations based on European legislation such as Solvency II, the General Data Protection Regulation, the Digital Operational Resilience Act (DORA) and the Corporate Sustainability Reporting Directive (CSRD), along with national legislation and regulations like the Dutch Financial Supervision Act, policy regulations and best practices from regulators and the Code of Conduct for Insurers. Our company culture is another major component herein.

We regularly evaluate the governance charter and will adjust it in 2025 based on our new management structure, taking the group executive board structure as a starting point. This section provides some background information on this matter.

Legal structure

DELA Coöperatie UA (hereafter: 'DELA’) is a cooperative for members with the following purposes:

- to help its members by serving their interests;

- ensuring policyholders and co-insured a dignified and affordable funeral;

- to improve the reputation of the life insurance market and the funeral sector.

DELA is a cooperative with exclusion of liability for its members. It is formed by all insured persons who become a member of the cooperative when entering into an insurance policy agreement with the cooperative. This was expanded in 2022, which means that newly insured persons in Belgium can also become a member of the cooperative. This also applies to existing members in 2024.

DELA includes DELA Holding NV and Voor Elkaar Holding NV. The Executive Board of the cooperative governs these two entities.

DELA Holding NV includes three principal companies: DELA Natura- en levensverzekeringen NV (hereafter: DELA Natura), DELA Uitvaartverzorging NV and DELA Holding Belgium NV.

DELA Natura accommodates all Dutch, Belgian and German insurance activities. The Belgian and German activities are carried out via a branch office of the Dutch insurance company.

DELA Uitvaartverzorging NV is responsible for funeral activities in the Netherlands. Belgian funeral activities are covered by the DELA Holding Belgium NV.

The principal companies include subsidiaries and participations. DELA Holding NV governs the principal companies. Each principal company governs its subsidiaries. In addition, each company may have a director. The authority of each director is defined per company in its statutes, in the authorisation regulations for the relevant company segment and in the Chamber of Commerce registrations.

Voor Elkaar Holding NV (VEH) was established to enhance solidarity and a sense of unity in society by means of cooperative business in the Netherlands. In 2024, VEH has made no new investments and is considering a new course and strategy.

Permits and supervision

DELA’s registration number at the Chamber of Commerce is 17012026.

DELA Natura is supervised by The Netherlands Authority for Financial Markets (AFM) and Dutch central bank (DNB), and is registered under licence number 12000437. The Chamber of Commerce registration number of DELA Natura is 17078393.

DELA Belgium carries out insurance activities which are accommodated by the Dutch company DELA Natura, and funeral activities that are part of Belgian companies. Other activities in Belgium take place within the entity DELA Enterprises NV. The insurance activities are carried out under the licence issued by DNB and prudential supervision activities are also overseen in Belgium by DNB. With regard to the supervision of conduct, DELA Belgium is accountable to the Belgian Financial Services and Markets Authority (FSMA).

The insurance activities in Germany take place via a branch office in Düsseldorf (article 2:115 Dutch Financial Supervision Act), with an emphasis on marketing and sales. Other financial and actuarial activities are carried out at the head office of DELA Natura in Eindhoven. The insurance activities and prudential supervision in Germany come under the license issued by DNB with supervision of conduct provided by the Bundesanstalt für Finanzdienstleistungsaufsicht.

Members

Only natural persons can become a member of the cooperative. To become a member, they must enter into an (insurance) agreement as determined by the general meeting. The cooperative is divided into 40 geographical departments. The numbers, names and boundaries of the departments are described in the rules of procedure. Each member of the cooperative is part of a department.

Belgian policyholders have also been able to become members of the cooperative since 2022, initially as part of the Eindhoven department. A separate Belgian department will be established in 2025.

DELA cooperative honorary members

Mr F.H.J. Boons

Mr J.L.R. van Dijk RA

Mr J.A.G. Dirks

Mr. E. Doeve

Mr W.M. van den Goorbergh

Mr S.C.J.J. Kortmann

Mr J. Kremers

Mr C.C.M. Libregts

Mr J.P. de Pender

Former DELA CEO Edzo Doeve and former DELA CFRO Jon van Dijk were appointed as honorary members in 2024.

General meeting

The DELA general meeting acts as the ‘highest body’ and is formed by individuals chosen from the members of the cooperative. It is preferred that candidate to become a member of the general meeting have been a DELA member for at least five years. The general meeting consists of one member and one replacement member from each department.

A complete and current overview of members per department is available on the DELA website via https:/www.dela.nl/over-dela/over-cooperatie-dela/governance/algemene-vergadering

Both the members and their replacements attend the general meeting, which regularly takes place twice a year.

The general meeting discusses issues important to DELA, such as the business plan for the coming year and the annual report of the concluded book year. In addition, it determines the financial statements and (normally) discharges the Executive and Supervisory Board. The general meeting also appoints directors and Supervisory Board members. Its approval is required for changes to some insurance conditions such as the annual premium increase of the DELA UitvaartPlan.

The general meeting is also provided with information about strategic developments of importance to the cooperative. Other topics discussed include the DELA Fund, complaint procedures and funeral service methods.

Confidential committee

A confidential committee comprised of four members is selected by the general meeting. Every member of the confidential committee is selected for a period of no more than four years. One member steps down each year in accordance with a schedule drawn up by the committee. A member who steps down can be immediately re-elected. The maximum term on the confidential committee is 12 years.

The confidential committee is tasked with promoting cooperation between the general meeting and the Executive Board and Supervisory Board within the framework of the general meeting’s authorities. To facilitate this role the confidential committee is invited by the Supervisory Board to meet with them prior to each general meeting, without any mandates or instructions. In addition, the committee has at least one meeting a year with the Executive Board alone.

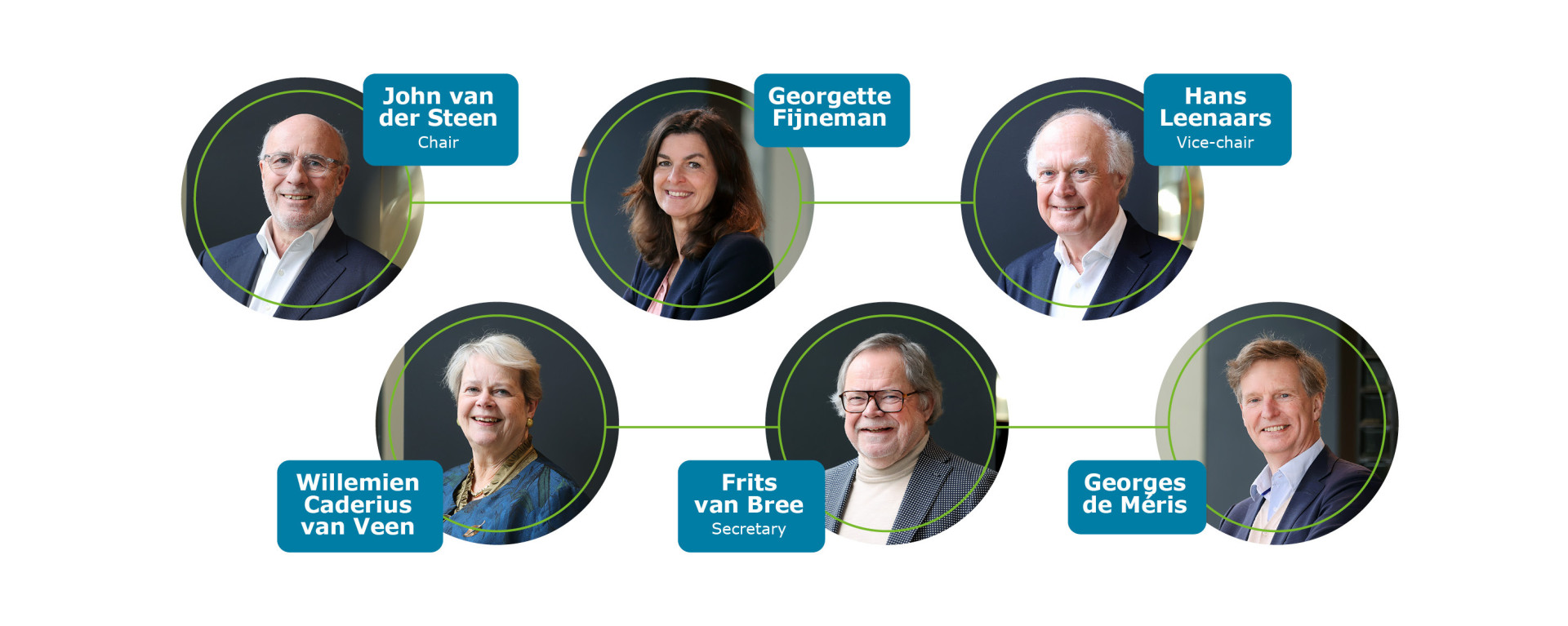

Supervisory Board

The Supervisory Board consists of at least five and at most seven natural persons as determined by this Board. At this moment, there are 6 members. If possible, two members will also be (replacement) members of the general meeting. The composition of the Supervisory Board is such that the combination of experience, expertise and independence of its members meets the Supervisory Board profile and allows it to perform its various duties. The members are appointed by the general meeting based on the suggestion of the Supervisory Board.

The tasks and duties of the Supervisory Board include overseeing, monitoring and providing advice to the Executive Board on:

- realisation of the goals of the cooperative;

- the strategy and risks related to its activities;

- the setup and functioning of internal risk management and control systems;

- the financial reporting process;

- compliance with legislation, regulations and the risk policy;

In addition, the Supervisory Board is responsible for:

- compliance with and enforcement of the corporate governance structure;

- approving the financial statements, budget and material capital investments;

- selecting and appointing the external accountant;

- approving the risk tolerance;

- nominating members of the Executive Board for appointment and resignation;

- determining the remuneration policy.

The Supervisory Board evaluates the remuneration policy and the functioning of the Executive Board. The chair is the point of contact for any alleged irregularities regarding the functioning of Executive Board members. In fulfilling its duties, Supervisory Board members focus on the interests of the cooperative and its associated companies. They carefully consider the interests of the various stakeholders of the cooperative in doing so, including members and employees. The Supervisory Board itself is responsible for the quality of its own functioning.

Regulations

The Supervisory Board has internal regulations that provide rules for its decision-making process. The regulations are drawn up by the Supervisory Board and adopted by the general meeting. They serve as a supplement to the regulations and guidelines that apply to the Supervisory Board based on Dutch legislation and the cooperative’s statutes.

Appointment and term

Each Supervisory Board member is appointed for a period of up to four years and can be re-appointed twice. The final four-year term will consist of two two-year periods with an interim evaluation. A member will step down at the latest after the first general meeting held after four years have passed since their last appointment. A member who is stepping down can be reappointed immediately, insofar as the maximum term of 12 years is not exceeded.

Committees

The Supervisory Board has an audit committee, risk committee and a remuneration and appointment committee.

Participations

The members of the DELA Supervisory Board are also appointed as Supervisory Board members for DELA Holding NV. and DELA Natura. The establishment of a Supervisory Board for DELA Natura was compulsory to meet the requirements of the Dutch Financial Supervision Act.

Personal details of the Supervisory Board

The Supervisory Board has six members. All are part of the Supervisory Board of DELA Coöperatie UA, DELA Holding NV. and DELA Natura- en levensverzekeringen NV.

J.W.Th. (John) van der Steen (1954), chair

- Male, Dutch citizen.

- Appointed in 2019, currently serving second term.

- Function: professional supervisor, DGA Ansteen Holding BV.

- Other additional functions: chair of Supervisory Board of BinckBank NV, chair of Supervisory Board of Princess Sportsgear & Traveller BV, member of the Executive Board of Stadhold (Randstad) Insurances SA and Stadhold Reinsurances SA, member of Executive Board of Vereniging AEGON, Ambassador for Royal Concertgebouw Orchestra.

J.J.A. (Hans) Leenaars RA (1952), vice-chair

- Male, Dutch citizen.

- Appointed in 2015. Currently in third term.

- Position: professional supervisor.

- Additional functions: member of Executive Board of Stichting John van Geunsfonds, chair of Supervisory Board of Stichting Het Klooster Breda, chair of Executive Board of Stichting Via Nobel, Chair of Advisory Board of ILFA BV.

G.C.A.M. (Frits) van Bree RA (1952), secretary

- Male, Dutch citizen.

- Appointed in 2021 by members of the general meeting, currently in first term.

- Position: professional supervisor.

- Additional functions: council member of Vereniging Eigen Huis.

W.A.P.J. (Willemien) Caderius van Veen RA (1959)

- Female, Dutch citizen.

- Appointed in 2014 and now in third term.

- Position: professional supervisor, DGA Caadje BV.

- Additional functions: member of Supervisory Board of Unilever Nederland Holdings BV, chair of the Review Committee Pensioenfonds Lloyds Register Nederland, member of Supervisory Board of Woningcorporatie Trivire, member of Supervisory Board of Ondernemingspensioenfonds Capgemini, member of Supervisory Board of the Dutch foundation for liver and gastrointestinal research (SLO) at EMC Rotterdam, chair of STOER foundation in Rotterdam.

G.M. (Georgette) Fijneman (1966)

- Female, Dutch citizen.

- Appointed in 2022, currently in first term.

- Position: chair of Executive Board of health insurance company Zilveren Kruis.

- Additional functions: vice-chair of Zorgverzekeraars Nederland, Executive Board member of Kansfonds, Ambassador for Nederlandse straatdoktersgroep (unpaid)

G.H.C. (Georges) de Méris FCA (1961)

- Male, Dutch citizen.

- Appointed in 2019 by members of the general meeting, currently serving second term.

- Position: Executive Board member and professional supervisor.

- Additional functions: chair of Executive Board of Stichting AK Stop Diabetes Invest, member of Supervisory Board of Omroep Brabant, chair of Supervisory Board of Hy2Care BV, chair of Supervisory Board of Caelus BV, chair of Supervisory Board of Matisse BV, board member at Stichting SFO.

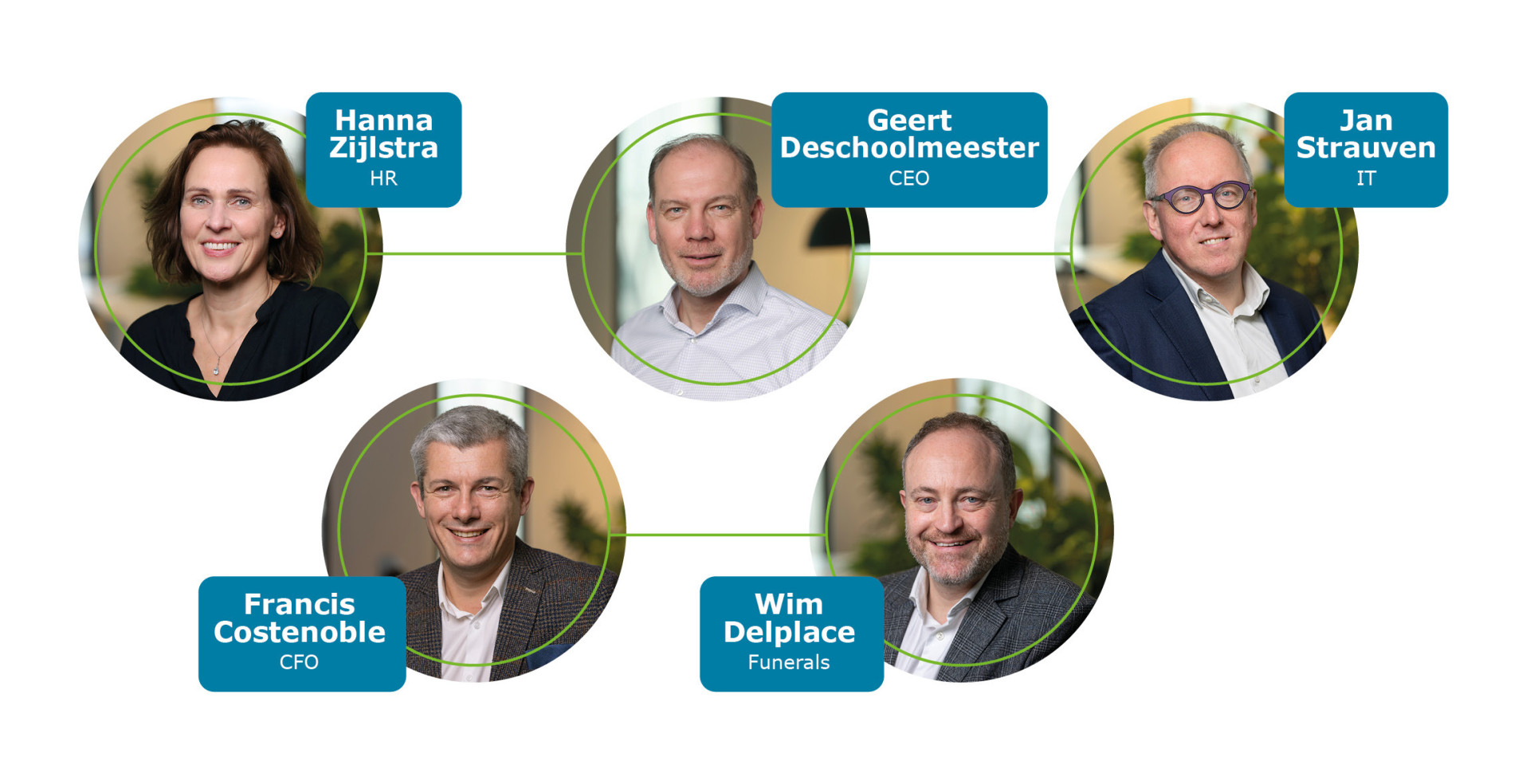

Executive Board

The cooperative has an Executive Board which consists of a CEO and a CFRO. Jon van Dijk was acting CFRO until his retirement in July 2024 when he was succeeded by Godelieve van Velsen. The CCO position was ended after Jack van der Putten stepped down on 25 January 2025. The Executive Board manages the cooperative and its capital within the limitations of the statutes. The Supervisory Board determines the number of members of the Executive Board.

Since 1 January 2025 DELA has an Executive Board for the entire cooperative, which consists of two statutory directors and three non-statutory directors, namely a CTO, an insurance director and a funeral services director, the latter of which is still vacant.

Personal details of the Executive Board

S.M.G. (Sandra) Schellekens – Lyppens (1965), CEO, chair

- Female, Dutch citizen.

- CEO, chair of Executive Board (since 27 January 2024).

- Focal areas: strategy, Human Resources, Internal Audit, Branding, administrative affairs, DELA Netherlands and DELA Belgium (until 1 March 2025).

- Executive Director of DELA Netherlands since 27 January 2024.

- Appointment period: four years, starting on 27 January 2024.

- Additional functions: Supervisory director at Rabobank Regio Eindhoven and ZLM Verzekeringen.

G. (Godelieve) van Velsen (1969), CFRO

- Female, Dutch citizen.

- CFRO, member of Executive Board (since 1 July 2024).

- Focal areas: Actuarial affairs, finance, investments, risk management, CSRD, tax and DELA Germany (until 1 March 2025).

- CFO of DELA Netherlands (since 1 July 2021).

- Appointment period: four years, starting on 1 July 2024.

- Additional functions: none.

T.C.A. (Tom) van der Spek (1966), CTO

- Male, Dutch citizen.

- CTO, member of Executive Board (since 15 October 2024).

- Focal areas: Transformation, purchase, innovation, digitisation and IT.

- Additional function: chair of Supervisory board Blue Sky Group.

G. (Geert) Deschoolmeester (1970), director insurance business unit

- Male, Belgian citizen.

- Director business insurance unit (since 1 March 2025).

- Focal areas: Insurance, DELA Germany and DELA Belgium.

- Additional function: none.

Independent business segments (ZBOs) and directors

DELA Group has two independent business segments (ZBOs), namely DELA Netherlands and DELA Belgium. ZBOs have their own management team. The management teams have regulations that include the responsibilities and authorisations of the team. One member of the Executive Board has been appointed as the primary person responsible for a business segment.

DELA Netherlands directors

Chris Beaulen became the funeral services director as of 15 November 2024. His previous position as cooperative & insurance director is currently being held ad interim by Nieke Martens.

DELA Belgium directors

Chantal Lensen became the interim insurance director on 1 August 2024, succeeding Geert Deschoolmeester who was appointed as CEO of DELA Belgium on 1 February 2024.

An independent business segment management team is tasked with implementing the strategy, managing and providing management information for the consolidation of the group, dealing with formal/legal issues, and sound decision-making as defined in the statutes of the segment and the regulations. This management model ensures professional and well-balanced operations with proper checks and balances.

DELA Germany

DELA Germany operates largely independently with their own director who reports to the Executive Board of the DELA Group.

Policy

The Executive Board of the cooperative is responsible for the policy of the entire group, i.e. the group policy. All policy is in principle group policy but should that prove not to be possible then a specific policy exists which relates to a ZBO within the group frameworks. The latter comes under the responsibilities of the management team of that segment. Group policy issues include sanctions, CDD (Wwft), DORA, data management, security, privacy, investments, capital management, ORSA, ALM, tax, reporting & control, branding, CSR, remuneration, risk management and internal control.

Investments

DELA Group’s investment activities are run from the Netherlands. DELA has an investment advisory committee (BAC) which has an advisory and evaluating role to the Executive Board on investments. In addition, it is asked for advice regarding policy proposals, policy changes and the implementation of policy in this field. The recommendations of the BAC and the decisions of the Executive Board are discussed with the Supervisory Board. The investment advisory committee has an explicit advisory role and evaluates whether proposals are consistent, comprehensive and sound with regard to return, risk and sustainability. The Executive and Supervisory Board maintain their own responsibilities. The investment advisory committee is composed of at least three external members who are appointed by the Supervisory Board as proposed by the Executive Board.

Risk management

DELA manages risks in order to achieve our long-term goals and gain insight into the sensitivities and correlations of strategic, financial, operational and compliance risks to ensure that we can effectively address developments and take timely action to realise our goals and secure continuity of the organisation.

In practice

DELA applies the ‘three lines of defence’ model for the setup of the management and control of risks:

- The first line is primarily responsible for achieving the company goals and realising internal control measures and to ensure effective risk management. Responsibilities of the first line include the operations, results, definition of risk appetite, management and compliance with internal control measures;

- The second line provides advice, coordinates, safeguards and evaluates – independently from the first line – whether or not the first line is actually taking responsibility and operating within the risk tolerance of DELA;

- The third line ensures additional assurance of the quality of internal control via audits.

The independence of the second and third lines is an important starting point to ensure this model functions properly, which is why it is safeguarded. The overview below shows a schematic representation of the model.

Process

We follow a process for risk management that ensures an insight into the main risks and opportunities in all circumstances. Opportunities, risks and applicable control measures are always carefully weighed. The Operational and Compliance Risk Management department facilitates the risk management process.

Identifying risks

Risk identification is primarily the responsibility of the first line. The second line periodically analyses the risks identified by the first line and supplements them where necessary, with a special focus on upcoming risks. This analysis is then discussed in meetings between the second and third line.

Below is a summarised risk profile for DELA. Further details of the risk categories included can be found in the risk section of the financial statements.

The figure above shows which risks are deemed important or less important. The overview is based on an estimate of the chance that a specific risk might occur combined with an estimate of the impact if that should be the case, taking into account the measures needed to limit the chance and/or impact.

Determining risk appetite and limits

The Executive Board evaluates the risk profile annually based on predetermined operational goals and the capacity of the organisation. In addition, the Board determines the risks DELA as an organisation is prepared to take – based on its risk profile – to achieve its strategic goals, in line with its risk appetite. In addition to the intended goals, it is essential that the continuity of the organisation is secured. The risk appetite consists of the risk appetite statements and the declarations on quality and quantity. These are translated into risk limits and risk tolerances to enable continuous monitoring and control. The table below shows the risk appetite for the main risk categories, with financial risks at the aggregated level.

With regards to strategic and financial risks, we are willing to accept uncertainty – as part of our business model – even when the potential benefits are uncertain. We apply a defensive attitude for integrity risks and aim to minimise these risks. Our appetite for operational risks falls in between the two. A detailed explanation of the risk categories we apply and the underlying risks is included in the financial statements.

Managing risks

Risk mitigation solutions are applied to ensure the risks remain within the desired bandwidths. In most situations this involves a suitable mix of:

- terminating or outsourcing activities;

- reducing risks by applying preventative measures;

- transferring risks via (re)insurance and/or the application of contract management;

- accepting risks that can be carried by the organisation itself.

If risks are outside of the predetermined risk limits – and therefore greater than desired – management will take additional mitigation measures. The deliberate breach of risk limits is only allowed with approval from the Executive Board, and only when of a temporary nature. The risk appetite statements will be evaluated and optimised in the beginning of 2025. Our risk appetite regarding these risks did not change in 2024.

Monitoring and reporting

Monitoring and evaluating risks and the risk management system are important preconditions for the type of learning organisation that we aim to be.

In assessing a risk an evaluation is made of whether it remains within the risk appetite level. The starting point is that risks exceeding the appetite are reduced to a lower risk level based on a good mix of risk mitigation solutions. To ensure constant risk monitoring, management determines KRIs (key risk indicators) for each risk within the risk profile, monitors the development of these indicators at least once per quarter, and evaluates the extent to which risk limits and tolerances are exceeded. Additional management actions are defined when breaches occur. In addition, the second and third line periodically report to the Executive Board.

Management periodically participates in a Risk Control Self Assessment (RCSA) process which results in a Control Statement (ICS). In addition, the Internal Audit department evaluates the setup and effectiveness of the risk management system.

Own Risk and Solvency Assesment

Solvency II requires a demonstrably balanced weighing up of risk management, capital management and the corporate strategy. The ORSA is the process structure for this assessment and the degree of compliance is shown in the ORSA report. The content of the scenarios and stress scenarios is determined by the Executive Board before the ORSA starts, after obtaining advice from the second line.

Management uses the Own Risk and Solvency Assessment (ORSA) at least once a year or when developments occur that may significantly affect the risk profile. This helps determine whether the risk profile is still appropriate in light of the company goals, risk appetite and available capital buffers. Various (stress) scenarios are taken into account in this process.

The results of the ORSA 2024 show that DELA’s solvency position is robust. In this year's ORSA the coverage ratio shows a gradual increase in the base scenario.Policyholders can therefore expect a significant profit share depending on their type of policy, while premium increases remain limited.

We have no influence on interest rates or inflation curves, but we can have some impact on the amount of funeral costs. The ORSA 2024 has again shown that scenarios with low funeral cost inflation (combined with low interest rates) can put pressure on the solvency and/or premium increase.

Capital management

Capital policy is aimed at maintaining a solid solvency position, in which we are constantly looking for a good balance between the amount of capital (assets) we maintain and the risks we face. In this framework, we have defined an internal minimum solvency capital requirement which we always aim to exceed. The requirement value for each licensed entity (DELA Cooperative and DELA Natura) has been established at 150 percent.

The capital policy defines various actions should the solvency ratio drop below the internal minimum solvency capital requirement. The solvency ratio was constantly higher than the solvency requirement during 2024.

For more details on risks and how they are managed please refer to the financial statements: ‘Consolidated financial statements’, ‘Notes on the consolidated balance sheet and income statement’, ‘4. Risk’.

Developments in 2024

While their management is a continuous process, risks do sometimes occur nonetheless. In this section we examine the risks faced in 2024 and the measures taken to minimise the chance and/or impact thereof. We also present some of the general measures taken to limit risks.

Strategic risks

Stress tests show that while our solvency position is robust, we are sensitive to scenarios with a low interest rate and low inflation. Preparatory measures are taken or different choices made where necessary. The main preconditions and measures are developed in the capital policy, which is evaluated annually. The risks are therefore considered limited and no additional capital has to be set aside. Stress tests were also performed with a focus on the impact of climate change. The conclusion to date is that our financial position is only slightly financially susceptible to this risk based on the current expectations.

Several (group) executive board changes were made in 2024. A start was made in the fourth quarter with drafting a new long-term business plan (2026–2030), which will be further developed in 2025. Long-term risks have been identified focused on financial robustness, and measures proposed where necessary to mitigate them. We are also examining how our organisational structure and risk management framework can best support these risks.

Integrity risks

Not complying with legislation and regulations is a risk that can harm our continuity and reputation. There were no serious incidents in this field in 2024. To further manage such risks we worked hard in 2024 on professionalising the procurement and outsourcing policy, having compliance with the applicable sanctions legislation and regulations as a precondition. Our policy was tested against standards such as DNB’s 'Good practice document for outsourcing by insurance companies’. In addition, we found options for improvement in how we handle the limited risk of conflicts of interest in sponsorship agreements. These improvements will be implemented in 2024.

Operational risks

Operational risks are caused by external influences, human error and the failure of processes and systems. Despite clear processes, responsibilities and reporting, these risks can never be fully excluded and it is important to learn from the past to prevent repeats in the future. The nature and scope of these incidents is very diverse and varies from several (attempted) cases of fraud and cyber-attacks to operational incidents in our funeral centres such as occupational accidents and errors related to cremations.

All these incidents have been assessed and, where necessary, extra measures taken such as improving instructions and/or tightening up protocols. We specifically focused on the throughput times of various steps in the process.

Internal control

In 2024, we continued the ‘Business in Control’ programme aimed at enhancing internal control and reducing operational and compliance risks. The objective of this programme is to improve and further standardise the maturity of risk management for operational and compliance risks. We also focused on implementing Governance, Risk and Compliance tooling in the Netherlands and evaluating the risk management system. The focus in 2025 will shift to further implementation and the rollout of the programme in Belgium and Germany.

Financial risks

While the financial markets are a source of risk they continued to recover in 2024 from the downturn in 2022. Interest rates declined slightly over the course of the year compared to 2023 and inflation also fell. The results of an ALM study conducted in 2024 led to a minor adjustment in our strategic asset allocation, with a slight increase in the strategic allocation to infrastructure at the expense of real estate and shares.

A further clarification on the development of the financial risks (including the associated quantification) is included in the risk section of the financial statements.